Motherson sumi ru4 qfy2010-180510

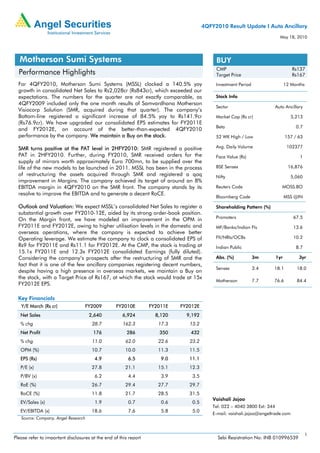

- 1. 4QFY2010 Result Update I Auto Ancillary May 18, 2010 Motherson Sumi Systems BUY CMP Rs137 Performance Highlights Target Price Rs167 For 4QFY2010, Motherson Sumi Systems (MSSL) clocked a 140.5% yoy Investment Period 12 Months growth in consolidated Net Sales to Rs2,028cr (Rs843cr), which exceeded our expectations. The numbers for the quarter are not exactly comparable, as Stock Info 4QFY2009 included only the one month results of Samvardhana Motherson Sector Auto Ancillary Visiocorp Solution (SMR, acquired during that quarter). The company’s Bottom-line registered a significant increase of 84.5% yoy to Rs141.9cr Market Cap (Rs cr) 5,213 (Rs76.9cr). We have upgraded our consolidated EPS estimates for FY2011E Beta 0.7 and FY2012E, on account of the better-than-expected 4QFY2010 performance by the company. We maintain a Buy on the stock. 52 WK High / Low 157 / 63 SMR turns positive at the PAT level in 2HFY2010: SMR registered a positive Avg. Daily Volume 102377 PAT in 2HFY2010. Further, during FY2010, SMR received orders for the Face Value (Rs) 1 supply of mirrors worth approximately Euro 700mn, to be supplied over the life of the new models to be launched in 2011. MSSL has been in the process BSE Sensex 16,876 of restructuring the assets acquired through SMR and registered a qoq Nifty 5,060 improvement in Margins. The company achieved its target of around an 8% EBITDA margin in 4QFY2010 on the SMR front. The company stands by its Reuters Code MOSS.BO resolve to improve the EBITDA and to generate a decent RoCE. Bloomberg Code MSS @IN Outlook and Valuation: We expect MSSL’s consolidated Net Sales to register a Shareholding Pattern (%) substantial growth over FY2010-12E, aided by its strong order-book position. On the Margin front, we have modeled an improvement in the OPM in Promoters 67.5 FY2011E and FY2012E, owing to higher utilisation levels in the domestic and MF/Banks/Indian FIs 13.6 overseas operations, where the company is expected to achieve better Operating leverage. We estimate the company to clock a consolidated EPS of FII/NRIs/OCBs 10.2 Rs9 for FY2011E and Rs11.1 for FY2012E. At the CMP, the stock is trading at Indian Public 8.7 15.1x FY2011E and 12.3x FY2012E consolidated Earnings (fully diluted). Considering the company’s prospects after the restructuring of SMR and the Abs. (%) 3m 1yr 3yr fact that it is one of the few ancillary companies registering decent numbers, Sensex 3.4 18.1 18.0 despite having a high presence in overseas markets, we maintain a Buy on the stock, with a Target Price of Rs167, at which the stock would trade at 15x Motherson 7.7 76.6 84.4 FY2012E EPS. Key Financials Y/E March (Rs cr) FY2009 FY2010E FY2011E FY2012E Net Sales 2,640 6,924 8,120 9,192 % chg 28.7 162.3 17.3 13.2 Net Profit 176 286 350 432 % chg 11.0 62.0 22.6 23.2 OPM (%) 10.7 10.0 11.3 11.5 EPS (Rs) 4.9 6.5 9.0 11.1 P/E (x) 27.8 21.1 15.1 12.3 P/BV (x) 6.2 4.4 3.9 3.5 RoE (%) 26.7 29.4 27.7 29.7 RoCE (%) 11.8 21.7 28.5 31.5 Vaishali Jajoo EV/Sales (x) 1.9 0.7 0.6 0.5 Tel: 022 – 4040 3800 Ext: 344 EV/EBITDA (x) 18.6 7.6 5.8 5.0 E-mail: vaishali.jajoo@angeltrade.com Source: Company, Angel Research 1 Please refer to important disclosures at the end of this report Sebi Registration No: INB 010996539

- 2. Motherson Sumi Systems I 4QFY2010 Result Update Consolidated Results above expectations; Forex gain boosts Bottom-line For 4QFY2010, MSSL clocked a 140.5% yoy growth in Net Sales to Rs2,028cr (Rs843cr), which exceeded our expectations. The numbers for the quarter are not exactly comparable, as 4QFY2009 include only the one month results of Samvardhana Motherson Visiocorp Solution (acquired during that quarter). The company’s Sales growth came largely on the back of this inorganic operation, wherein MSSL’s outside-India Revenue jumped by a significant 187.4% yoy to Rs1,306cr (Rs454cr). The company’s Bottom-line also registered a significant increase of 84.5% yoy to Rs141.9cr (Rs76.9cr), which again surpassed our expectation for the quarter. The Net Profit recorded a substantial jump, due to favourable currency movements (helped it register a Forex gain of Rs40cr) during the quarter. Lower Raw Material and favourable currency movements push Margins up yoy; qoq improvement seen on improved, higher Operating efficiencies For 4QFY2010, MSSL witnessed a 361bp yoy increase in its EBITDA Margin to 14.8% (11.2%) owing to favourable currency movements and a 336bp yoy decline in Raw Material costs. Other expenditure, however, recorded a yoy increase of 180bp, while Staff cost to Sales remained flat yoy. The OPM improved by around 387bp on a qoq basis as well. Thus, the higher Top-line aided Operating Profit growth, which surged by 217.8% yoy to Rs301.1cr during 4QFY2010. However, higher Interest and Depreciation resulted in a 84.5% yoy jump in the Net Profit to Rs141.9cr. Exhibit 1: 4QFY2010 Performance (Consolidated) Y/E March (Rs cr) 4QFY10 4QFY09 % chg FY10 FY09 % chg Net Sales (include Other 2,028 843 140.5 6,924 2,640 162.3 Op. Inc.) Consumption of RM 1,193 524 127.5 4,166 1,549 168.9 (% of Sales) 58.8 62.2 60.2 58.7 Staff Costs 301.9 126.2 139.3 1,131.9 344.0 229.1 (% of Sales) 14.9 15.0 16.3 13.0 Exchange Fluctuation (51.8) (4.9) 951.1 (64.9) 33.1 (296.1) (% of Sales) (2.6) (0.6) (0.9) 1.3 Other Expenses 283.9 102.9 175.9 996.1 418.7 137.9 (% of Sales) 14.0 12.2 14.4 15.9 Total Expenditure 1,727 749 130.7 6,229 2,345 165.6 Operating Profit 301.1 94.8 217.8 695.0 294.7 135.9 OPM 14.8 11.2 10.0 11.2 Interest 21.5 11.2 91.7 62.0 35.4 75.0 Depreciation 77.7 35.4 119.6 260.1 97.9 165.7 Other Income 0.7 2.4 (71.7) 12.9 5.0 159.5 PBT (excl. Extr. Items) 202.7 50.6 300.6 385.8 166.3 132.0 Extr. Income/(Expense) 24.0 (43.5) - 33.7 (44.8) - PBT (incl. Extr. Items) 178.7 94.1 89.9 352.1 211.1 66.8 (% of Sales) 8.8 11.2 5.1 8.0 Provision for Taxation 36.8 17.2 114.0 109.4 34.9 213.7 (% of PBT) 20.6 18.3 31.1 16.5 Reported PAT 141.9 76.9 84.5 242.7 176.3 37.7 PATM 7.0 9.1 3.5 6.7 Equity capital (cr) 37.5 35.6 37.5 35.6 EPS (Rs) 3.8 2.2 75.1 6.5 5.0 30.7 Source: Company, Angel Research May 18, 2010 2

- 3. Motherson Sumi Systems I 4QFY2010 Result Update Standalone Performance On a Standalone basis as well, the company reported a robust 69.9% yoy growth in its Top-line to Rs552cr (Rs325cr), and a 242.3% yoy increase in the Bottom-line to Rs57.9cr (Rs16.4cr). The Net Profit includes an exchange difference profit of Rs40cr (Rs1.3cr loss in 4QFY2009). The OPM (excluding exchange differences) stood higher at 19.4% (17.9%). Raw material and Staff costs have witnessed a decline on a yoy basis, while the Other expenditure increased by about 147bp yoy. Exhibit 2: 4QFY2010 Performance (Standalone) Y/E March (Rs cr) 4QFY10 4QFY09 % chg FY10 FY09 % chg Net Sales (include Other Op. 551.9 324.8 69.9 1,758.1 1,322.9 32.9 Inc.) Consumption of RM 315.8 189.9 66.3 1,022.2 779.5 31.1 (% of Sales) 57.2 58.5 58.1 58.9 Staff Costs 44.9 32.2 39.6 164.5 136.0 21.0 (% of Sales) 8.1 9.9 9.4 10.3 Exchange Fluctuation (40.0) 1.3 - (55.5) 31.8 - (% of Sales) (7.3) 0.4 (3.2) 2.4 Other Expenses 84.0 44.7 88.0 264.8 205.2 29.1 (% of Sales) 15.2 13.8 15.1 15.5 Total Expenditure 404.7 268.1 51.0 1,396.0 1,152.3 21.1 Operating Profit 147.2 56.8 159.3 362.1 170.5 112.4 OPM 26.7 17.5 20.6 12.9 Interest 5.7 7.2 (20.3) 26.5 29.1 (8.9) Depreciation 18.4 14.9 23.6 64.6 54.5 18.5 Other Income 1.1 2.0 (42.7) 16.0 9.3 71.7 PBT (excl. Extr. Items) 124.2 36.7 238.5 287.0 96.2 198.2 Extr. Income/(Expense) 20.0 11.0 - 20.0 11.0 - PBT (incl. Extr. Items) 104.2 25.7 305.6 267.0 85.2 213.3 (% of Sales) 18.9 7.9 15.2 6.4 Provision for Taxation 46.3 9.3 399.0 88.6 15.7 464.2 (% of PBT) 44.4 36.1 33.2 18.4 Reported PAT 57.9 16.4 252.8 178.5 69.5 156.6 PATM 10.5 5.1 10.2 5.3 Equity capital (cr) 37.5 35.6 37.5 35.6 EPS (Rs) 1.5 0.5 242.3 4.8 2.0 143.3 Source: Company, Angel Research Segment-wise Performance The Auto Segment clocked an 83.2% yoy increase in Sales to Rs539cr (Rs294cr), while Non-Auto Sales jumped 84.6% yoy to Rs49.5cr (Rs26.8cr) in 4QFY2010. The Auto Segment EBIT increased by almost 186.3% yoy to Rs95.2cr (Rs33.2cr), while Non-Auto EBIT spiked a substantial 139.5% yoy to Rs8.3cr (Rs3.5cr) during the quarter. May 18, 2010 3

- 4. Motherson Sumi Systems I 4QFY2010 Result Update Exhibit 3: 4QFY2010 Segmental Performance Y/E Mar (Rs cr) 4QFY10 4QFY09 % chg FY10 FY09 % chg Total Net Sales 613.7 327.9 87.2 1,845.7 1,343.6 37.4 Auto Segment 538.8 294.1 83.2 1,593.5 1,168.5 36.4 Non-Auto Segment 49.5 26.8 84.6 178.8 147.0 21.6 Other Segments 25.4 6.9 73.5 28.0 Total EBIT 103.5 36.7 181.9 238.8 120.4 98.4 Auto Segment 95.2 33.2 186.3 209.8 108.0 94.3 Non-Auto Segment 8.3 3.5 139.5 29.1 12.4 134.0 EBIT Margin (%) 16.9 11.2 12.9 9.0 Auto Segment 17.7 11.3 13.2 9.2 Non-Auto Segment 16.8 12.9 16.3 8.5 Source: Company, Angel Research SMR turns positive at the PAT level in 2HFY2010 During 4QFY2009, MSSL acquired a global company in the business of rear view mirrors from Visiocorp PLC, with Revenues in excess of Euro 660mn and a normalised EBITDA of approximately Euro 48mn during 2007. Visiocorp PLC was one of the largest players in the rear view mirror business and its customers include General Motors, Ford, Hyundai, Volkswagen, Renault/Nissan, Mercedes Benz, BMW, Audi, Tata JLR and Maruti Suzuki. The acquired entity was incorporated as Samvardhana Motherson Reflectec (SMR) in New Jersey on March 6, 2009, and 95% was owned by Samvardhana Motherson Global Holdings (SMGHL). The deal was executed for a cash consideration of Euro 24.8mn and the issue of consideration shares amounting to Euro 1.5mn to the lenders of the erstwhile Visiocorp Group. SMGHL is a JV between the company and Samvardhana Motherson Finance through their overseas 100% subsidiaries (incorporated in Mauritius). SMGHL has acquired various operating companies engaged in the design, manufacture, assembly of rear view mirrors, operating in Europe, America, Australia and Asia (including India), where MSSL has a successful joint venture (JV), in which it holds 49% stake. SMR registered a positive PAT in 2HFY2010. Additionally, during FY2010, SMR received orders for the supply of mirrors worth approximately Euro 700mn to be supplied over the life of the new models to be launched in 2011. MSSL has been in the process of restructuring the assets acquired through SMR and registered a qoq improvement in Margins. The company achieved its target of around an 8% EBITDA margin in 4QFY2010 on the SMR front. The company stands by its resolve to improve the EBITDA and to generate a decent RoCE. Exhibit 4: SMR Performance (Rs cr) 1QFY10 2QFY10 3QFY10 4QFY10 FY10 Net Sales 882.4 973.9 1,120.6 1,181.9 4,158.7 India 32.2 36.4 42.3 48.4 159.3 Outside India 850.2 937.5 1,078.2 1,133.5 3,999.5 PBIDT 15.1 45.2 72.8 103.1 236.2 OPM(%) 1.7 4.6 6.5 8.7 5.7 Exceptional Inc. / (exp) (17.1) (22.9) (9.0) 92.1 43.0 PAT (44.4) (24.3) 9.2 68.1 8.7 Minority Share (22.1) (13.8) 4.4 34.1 2.8 PAT (22.3) (10.5) 4.7 33.8 5.9 Source: Company, Angel Research May 18, 2010 4

- 5. Motherson Sumi Systems I 4QFY2010 Result Update Outlook and Valuation MSSL is a leader in Wire Harnessing, controlling over 65% of the domestic passenger vehicle (PV) market and around a 48% market share in the domestic Rear View Mirror market. After the recent acquisition, the company now controls around 25% of the global Rear View Mirror market. The company is now focusing on the supply of higher level assemblies and modules, where Margins are comparatively higher. MSSL is also increasing its content per car, in a bid to diversify its product portfolio. The company is laying emphasis on its global product plan (GPP), where it is looking at setting up JVs with leading Tier-I suppliers to upgrade its technology base and to bolster its clientele as well. We expect MSSL’s consolidated Net Sales to register a substantial growth over FY2010-12E, aided by its strong order-book position. On the Margin front, we have modeled an improvement in the OPM in FY2011E and FY2012E, owing to higher utilisation levels in the domestic and overseas operations, where the company is expected to achieve better Operating leverage. We estimate the company to clock a consolidated EPS of Rs9 for FY2011E and Rs11.1 for FY2012E. At the CMP, the stock is trading at 15.1x FY2011E and 12.3x FY2012E consolidated Earnings (fully diluted). Considering the company’s prospects after the restructuring of SMR and the fact that it is one of the few ancillary companies registering decent numbers, despite having a high presence in overseas markets, we maintain a Buy on the stock, with a Target Price of Rs167, at which the stock would trade at 15x FY2012E EPS. Exhibit 5: One year forward P/E Band 200 180 19x 160 140 15x Share Price (Rs) 120 11x 100 80 7x 60 40 20 0 Apr-02 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Oct-02 Oct-03 Oct-04 Oct-05 Oct-06 Oct-07 Oct-08 Oct-09 Source: Company, Angel Research Exhibit 6: One year forward EV/EBIDTA Band 9,000 9x 8,000 7,000 7x 6,000 5,000 EV (Rs cr) 5x 4,000 3,000 3x 2,000 1,000 0 Apr-02 Apr-03 Apr-04 Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Oct-02 Oct-03 Oct-04 Oct-05 Oct-06 Oct-07 Oct-08 Oct-09 Source: Company, Angel Research May 18, 2010 5

- 6. Motherson Sumi Systems I 4QFY2010 Result Update Profit & Loss Statement (Rs cr) Y/E March FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E Gross sales 1,706 2,272 2,783 7,526 8,826 9,991 Less: Excise duty 179 244 188 602 706 799 Net Sales 1,528 2,052 2,640 6,924 8,120 9,192 Total operating income 1,528 2,052 2,640 6,924 8,120 9,192 % chg 50.4 34.3 28.7 162.3 17.3 13.2 Total Expenditure 1,307 1,755 2,356 6,229 7,207 8,135 Net Raw Materials 864 1,124 1,549 4,166 5,055 5,791 Other Mfg costs 112 142 141 - 406 460 Personnel 168 247 344 1,132 1,177 1,241 Other 163 242 322 931 568 643 EBITDA 221 297 283 695 914 1,057 % chg 38.5 34.6 (4.6) 145.2 31.4 15.7 (% of Net Sales) 14.4 14.5 10.7 10.0 11.3 11.5 Depreciation& Amortisation 65 85 109 260 288 314 EBIT 156 212 174 435 626 743 % chg 38.0 36.1 (17.9) 149.4 43.9 18.7 (% of Net Sales) 10.2 10.4 6.6 6.3 7.7 8.1 Interest & other Charges 29 29 38 62 53 46 Other Income 35 43 120 13 14 14 (% of PBT) 21.9 20.5 47.0 3.8 2.3 2.0 Recurring PBT 162 226 256 386 587 711 % chg 28.9 39.4 13.1 50.8 52.1 21.2 Extraordinary Expense/(Inc.) 0 19 1 43 - - PBT (reported) 162 207 255 343 587 711 Tax 34 51 35 109 191 231 (% of PBT) 20.7 24.7 13.6 31.9 32.5 32.5 PAT (reported) 128 156 220 233 396 480 Less: Minority interest (MI) (1) (3) 45 (9) 46 49 PAT after MI (reported) 129 159 175 243 350 432 ADJ. PAT 130 178 176 286 350 432 % chg 20.9 37.3 (0.9) 62.0 22.6 23.2 (% of Net Sales) 8.5 8.7 6.7 4.1 4.3 4.7 Basic EPS (Rs) 3.7 4.5 4.9 6.5 9.0 11.1 Fully Diluted EPS (Rs) 3.3 4.1 4.5 6.3 9.0 11.1 % chg 20.1 22.9 10.3 38.5 44.4 23.2 May 18, 2010 6

- 7. Motherson Sumi Systems I 4QFY2010 Result Update Balance Sheet (Rs cr) Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E SOURCES OF FUNDS Equity Share Capital 23 36 36 37 39 39 Preference Capital - - - - - - Reserves& Surplus 356 500 748 1,122 1,330 1,501 Shareholders Funds 380 536 783 1,159 1,369 1,539 Minority Interest 14 23 200 191 237 285 Total Loans 460 489 895 757 657 607 Deferred Tax Liability 7 4 15 15 12 8 Total Liabilities 861 1,052 1,893 2,122 2,275 2,440 APPLICATION OF FUNDS Gross Block 762 949 3,018 3,297 3,641 3,979 Less: Acc. Depreciation 277 346 1,628 1,888 2,175 2,490 Net Block 485 603 1,390 1,409 1,466 1,489 Capital Work-in-Progress 18 28 151 165 182 199 Goodwill - - - - - - Investments 5 5 8 11 11 12 Current Assets 677 904 1,914 3,623 4,025 4,208 Cash 99 95 277 49 68 47 Loans & Advances 136 190 413 1,039 1,218 1,379 Other 441 618 1,224 2,535 2,739 2,783 Current liabilities 382 531 1,597 3,086 3,410 3,469 Net Current Assets 295 373 317 537 615 739 Mis. Exp. not written off 58 42 27 - - - Total Assets 861 1,052 1,893 2,122 2,275 2,440 Cash Flow (Consolidated) (Rs cr) Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E Profit before tax 162 207 255 343 587 711 Depreciation 65 85 109 260 288 314 Change in Working Capital 12 (52) (752) (549) (198) (223) Less: Other income 142 48 (450) 247 56 108 Direct taxes paid 34 51 35 109 191 231 Cash Flow from Operations 64 141 27 (303) 430 463 Inc./ (Dec.) in Fixed Assets 184 197 2,191 293 361 355 Inc./ (Dec.) in Investments 0 0 3 2 1 1 Inc./ (Dec.) in loans and advances 28 55 222 626 179 80 Other income 28 10 1,825 - - - Cash Flow from Investing (156) (232) 1,234 (921) (542) (435) Issue of Equity - 12 - 2 1 - Inc./(Dec.) in loans 34 29 406 (138) (100) (50) Dividend Paid (Incl. Tax) 31 42 56 57 77 113 Others (7) (12) 17 - - - Cash Flow from Financing 13 11 333 (193) (175) (163) Inc./(Dec.) in Cash (79) (4) 178 (227) 19 (22) Opening Cash balances 172 99 95 277 49 68 Closing Cash balances 99 95 277 49 68 47 May 18, 2010 7

- 8. Motherson Sumi Systems I 4QFY2010 Result Update Key Ratios Y/E March FY2007 FY2008 FY2009 FY2010E FY2011E FY2012E Valuation Ratio (x) P/E (on FDEPS) 37.3 30.6 27.8 21.1 15.1 12.3 P/CEPS 24.9 18.7 14.7 10.2 8.3 7.1 P/BV 12.8 9.1 6.2 4.4 3.9 3.5 Dividend yield (%) 1.1 1.0 1.0 1.3 1.8 2.2 EV/Sales 3.1 2.3 1.9 0.7 0.6 0.5 EV/EBITDA 23.8 17.7 18.6 7.6 5.8 5.0 EV / Total Assets 5.7 4.7 2.7 2.5 2.3 2.1 EPS (Basic) 3.7 4.5 4.9 6.5 9.0 11.1 EPS (fully diluted) 3.3 4.1 4.5 6.3 9.0 11.1 Cash EPS 5.5 7.3 9.3 13.4 16.5 19.2 DPS 1.0 1.3 1.3 1.8 2.5 3.0 Book Value 10.7 15.0 22.0 30.9 35.3 39.7 Dupont Analysis EBIT margin 10.2 10.4 6.6 6.3 7.7 8.1 Tax retention ratio 0.8 0.8 0.9 0.7 0.7 0.7 Asset turnover (x) 2.3 2.4 2.1 3.8 3.8 4.0 ROIC (Post-tax) 18.8 18.7 11.7 16.1 19.8 21.8 Cost of Debt (Post Tax) 5.2 4.6 4.8 5.1 5.0 4.9 Leverage (x) 0.9 0.8 0.8 0.7 0.5 0.4 Operating ROE 31.0 30.1 17.0 23.5 27.2 28.4 Returns (%) ROCE (Pre-tax) 19.6 22.2 11.8 21.7 28.5 31.5 Angel ROIC (Pre-tax) 20.5 22.3 10.8 21.0 28.4 31.1 ROE 38.5 38.9 26.7 29.4 27.7 29.7 Turnover ratios (x) Asset Turnover (Gross Block) 2.3 2.4 1.3 2.2 2.3 2.4 Inventory / Sales (days) 41 44 62 42 47 47 Receivables (days) 46 51 65 81 73 61 Payables (days) 51 55 110 103 126 119 WCapital cycle (ex-cash) (days) 35 42 22 14 23 25 Solvency ratios (x) Net debt to equity 0.9 0.7 0.8 0.6 0.4 0.4 Net debt to EBITDA 1.6 1.3 2.2 1.0 0.6 0.5 Interest Coverage (EBIT / Int.) 5.3 7.4 4.5 7.0 11.9 16.3 May 18, 2010 8

- 9. Motherson Sumi Systems I 4QFY2010 Result Update Research Team Tel: 022-4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Securities Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, and is for general guidance only. Angel Securities Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Securities Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Securities Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Securities Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Disclosure of Interest Statement Motherson Sumi 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies’ Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below Rs 1 lakh for Angel and its Group companies. . Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059. Tel: (022) 3952 4568 / 4040 3800 Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 May 18, 2010 9